5 Ways to Crowdfund Your Business

As you stride through the process of launching a new idea, it should be apparent that you will need funding. Previously, entrepreneurs might have relied on help from their family and friends or even a small loan from a bank to make their dream a reality. Today’s entrepreneurs have access to various funding options which can take their business from inception into reality.

Here are a few crowdfunding websites you can use to help achieve your business goals.

The Small Business Association provides practical steps a business owner can take and resources. You can learn about various business topics, including launching, managing, and growing a business. One funding option is the SBA-backed loans: 7(a) loans, 504 loans, and microloans.

Also, the SBA provides business owners with information on other funding options, which include grants and disaster assistance. Another benefit of the SBA is access to their learning centers and assistance within your local business community. Don’t hesitate to connect with others with more experience, as small business owners can help each other and improve services to help more customers.

Indiegogo is a crowdfunding platform to consider for your next campaign to promote your next project or product. You can offer perks and take your audience on the journey through the landscape of your latest idea.

One platform that millions of creative people worldwide use to solve problems in unconventional ways is Indiegogo. Whether you’re a designer, filmmaker, or visionary this platform could help you connect with other people and turn those dreams into reality.

According to the Indiegogo website, backers have grown to over 9 million strong and represent 235 countries and territories. Over 19,000 campaigns are launched on Indiegogo every month.

If you’re working on a live campaign to promote your latest hybrid event for your music agency or need help turning an abstract concept into a functioning prototype, consider joining this community.

NAV is a fintech company dedicated to helping small business owners succeed. The company offers various small business resources, which include small business loans, credit cards, checking, and more.

Using Nav, you’ll access more information about your business’s data, allowing you to make more informed financial decisions.

According to Nav’s website, users can access custom data-focused business solutions that clarify your business’s financial health. A few perks of the marketplace include individualized recommendations from over 100 financing options, matches to financing options 3.5 times more likely to be approved, business, loans, credit cards, insurance, and more.

Hello Alice, helps women and minority small business owners on their business journey. The organization ensures that small business owners have access to funding information such as grants and business loans.

This platform was designed for small business owners, by small business owners. According to Hello Alice’s website, the company works on behalf of over 800,000 small business owners to acquire business solutions and funding opportunities.

Don’t forget to sign up to Hello Alice to receive access to exclusive offerings, workshops, and other forms of support as you grow your small business.

Patreon is a platform that a small business owners can use if they know their business provides a level of value that their community would benefit from. You can create an account and offer your members tiers for your current project.

Don’t be afraid to review Patreon’s For Creators section to learn why the platform is worth considering for funding your next project.

According to Patreon’s website, over 200,000 local businesses have used the service to build sustainable, reliable incomes and strengthen relationships with long-time supporters.

Patreon allows you to grow your online community by connecting with your customers in meaningful ways, such as through live-streamed events, discount codes, and more.

It’s important to remember that your finances should be organized and prepared for the application process that you will find when attempting to access most loans and grants.

So, there’s lots of help out there. The most important thing to do next is to get your goals and mission in mind, get organized, and go for it!

Amazon Associate Disclaimer

The owner of this website is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon properties including, but not limited to, amazon.com, endless.com, myhabit.com, smallparts.com, or amazonwireless.com.

Affiliate Disclosure

Disclosure of Material Connection: Some of the links in this website are affiliate links. This means if you click on the link and purchase the item, the owner of this website will receive an affiliate commission. Regardless, the owner of this website only recommends products or services that will add value to the readers. The owner of this website is disclosing this information in accordance with the Federal Trade Commission’s 16 CFR, Part 255: Guides Concerning the Use of Endorsements and Testimonials in Advertising.

Team UMAG

MORE FROM URBAN MATRIX MAG

Learn about Social Security Benefits and Pensions at the Chicago Public Library

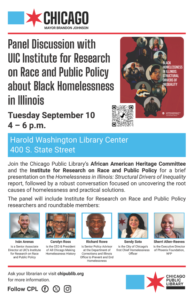

Black Homelessness in Illinois Report at Harold Washington Library

5 SCORE events to attend in August to grow your business

Tell Our Team!

Recent Posts

Hi Impact