organization-of your-finances

One of the most important things you can do for your business and, most importantly, for yourself is the organization of your finances. Ordinary people learn to accept their disorganized nature, but to finance dreams and fulfill your personal needs, you should NEVER let your finances be in disarray.

Maybe you’ve heard of the phrase ‘living check-to-check’, or you’re familiar with that time of the month when you’ll need to ‘tighten your belt’. It’s because many people find themselves cash strapped at the end of the month. Sometimes it’s due to overdraft fees. Other times, late monthly fees are an even more significant concern. When you organize your finances, you dramatically reduce the likelihood of such ills.

Follow these seven steps to whip your finances into shape, making them more organized than you ever thought possible.

Maintaining your finances is pretty straightforward and gets easier the longer you stay organized.

1

Go over your budget at the beginning and middle of every month. No two months are the same, so ensure the upcoming month’s budget. Doing this sets realistic expectations and helps you plan adequately. Your mid-month check is to make sure things stay on track. Watch out for things like summer vs. winter electrical bills.

- Make one now! Once you have the right tools, searching for a template is easy. Budgets are critical! Your budget is the key to creating a way to make your money work for you.

2

Having a digital way to work with your money might be just what you need to help you stay committed to your financial goals. You might find out that you like working with your money; learning how cash flows in and out of your business can help you develop better leads-seeking strategies and a more efficient workflow.

3

After you’ve taken care of all the bills, retain only the records you need and shred the rest to protect yourself from identity theft.

4

Pay bills weekly for the weeks ahead. Each week, pay any statements due in the next couple of weeks. Make a habit of paying your bills on the same day each week. This way, you’re developing good habits, helping you to stay organized.

5

If you aren’t using software to keep track of your bills, make a checklist. Your list should include all your recurring bills with the noted day, the amount due, the date the bill was expected, and the date the bills were paid. Non-recurring bills can be added to the checklist when they arrive.

6

It is well known that a source of stress in relationships is financial matters. Therefore, it is worth it to work out an effective system before it becomes challenging.

7

Have two accounts. Avoid overdraft fees and mishaps by having one account used only to pay bills. Use different accounts for everything else.

Maintaining your finances is pretty straightforward and gets easier the longer you stay organized. Eliminate all financial clutter in your life to reduce any chance of failure due to mental chaos.

Amazon Associate Disclaimer

The owner of this website is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon properties including, but not limited to, amazon.com, endless.com, myhabit.com, smallparts.com, or amazonwireless.com.

Some of the links in this website are affiliate links. This means if you click on the link and purchase the item, the owner of this website will receive an affiliate commission. Regardless, the owner of this website only recommends products or services that will add value to the readers. The owner of this website is disclosing this information in accordance with the Federal Trade Commission’s 16 CFR, Part 255: Guides Concerning the Use of Endorsements and Testimonials in Advertising.

TEAM UMAG

MORE FROM URBAN MATRIX MAG

5 SCORE events you can attend to improve your business skills in June

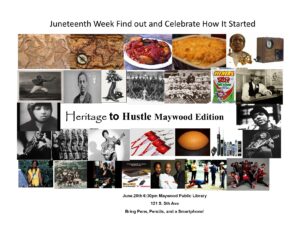

Heritage to Hustle Maywood Edition

Learn How to Grow Your Business and Skills with these 5 webinars

Tell Our Team!

Recent Posts

Hi Impact